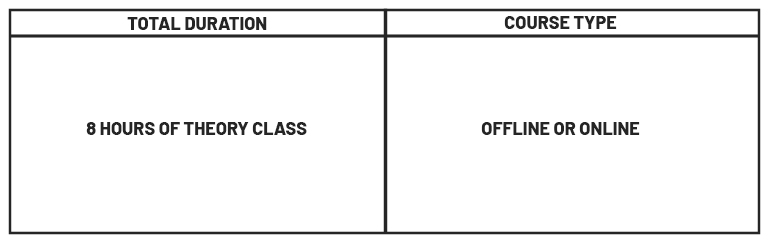

Silver Course

TECHNICAL ANALYSIS + BASIC OF FUTURES AND OPTIONS

Let’s cover both technical analysis and the basics of futures and options in the stock market

TECHNICAL ANALYSIS:

Technical analysis is a method of evaluating securities by analyzing statistical trends and patterns in historical price and volume data. It assumes that past price movements can help predict future price movements.

Let’s cover both technical analysis and the basics of futures and options in the stock market

HERE ARE SOME KEY ASPECTS OF TECHNICAL ANALYSIS:

Price Charts: Technical analysts use price charts, such as line charts, bar charts, and

candlestick charts, to visualize price patterns and trends over time.

Trend Analysis: Technical analysts identify trends in price movements, including uptrends

(higher highs and higher lows) and downtrends (lower highs and lower lows). They use

trendlines to connect significant price levels and determine support and resistance areas.

Indicators: Technical indicators are mathematical calculations applied to price and volume

data. They help traders identify potential buy or sell signals and gauge the strength of price

movements. Examples of indicators include moving averages, relative strength

https://traderstrainingacademy.co.in (RSI),

and moving average convergence divergence (MACD).

Chart Patterns: Technical analysts look for recurring chart patterns that may indicate

potential trend reversals or continuation. Common patterns include head and shoulders,

double tops and bottoms, triangles, and flags.

Support and Resistance: Support levels are price levels where buying interest is expected

to outweigh selling pressure, causing prices to bounce back up. Resistance levels are price

levels where selling pressure is expected to outweigh buying interest, causing prices to

reverse downward.

BASICS OF FUTURES AND OPTIONS:

Futures: A futures contract is an agreement to buy or sell an underlying asset at a

predetermined price on a specific future date. Key terms include the underlying asset,

contract size, expiration date, and contract price. Futures can be used for speculation or

hedging purposes.

Options: An options contract grants the buyer the right, but not the obligation, to buy (call

option) or sell (put option) an underlying asset at a predetermined price within a specific

timeframe. Key terms include the underlying asset, strike price, expiration date, and

premium paid. Options provide flexibility and can be used for various strategies, including

hedging, and generating income.

Long and Short Positions: In futures and options, a long position refers to buying the

contract, expecting prices to rise. A short position refers to selling the contract, anticipating

prices to fall. Both long and short positions can be taken for speculative or hedging

purposes.

Leverage: Futures and options provide leverage, allowing traders to control a larger

position with a smaller capital outlay. Leverage amplifies both potential profits and losses,

so caution is advised when using leverage.

Risk Management: Risk management is crucial in futures and options trading. Techniques

such as stop-loss orders, position sizing, and diversification can help manage risks and

protect against excessive losses.

Below are the topics covered in silver course; in addition to foundation course:

© Copyright by Traders Training Academy